When you see huge Travel Agents such as Thomas Cook collapse, it makes you wonder about financial protection.

If your cruise line or your travel agent goes under, can you get your money back?

And does an ATOL certificate provide any insurance?

Is Your Cruise Financially Protected?

If you’ve been issued with an ATOL certificate, should the worst happen and either the cruise company or the travel agent collapses, you should be protected.

But what if they don’t issue an ATOL certificate?

To find out, let’s look at what ATOL actually is – and what it does:

What’s ATOL?

- ATOL is the Government-backed holiday protection scheme.

- ATOL stands for “Air Travel Organiser’s Licence”.

- Every UK-based travel company that sells air holidays must issue an ATOL certificate as soon as customers pay any money towards their trip.

- You probably won’t be ATOL protected if you book a cruise with no flights.

If you’re flying as part of your cruise holiday, you should be given an ATOL certificate.

Make sure that everything you booked (flights, cruise, hotels, etc) is listed on it.

You can read more about ATOL, and how to make a claim if you need to, on their website, here.

But do notice that ATOL includes the words Air Travel – which implies that it only covers holidays which include air travel.

So your cruise ticket is unlikely to be ATOL protected if there are no flights associated with it.

What can you do about it?

Well… non-fly cruises sold in the UK should be protected by ABTA (Association of British Travel Agents).

What’s ABTA?

Here’s what ABTA is and what it covers:

- ABTA stands for the “Association of British Travel Agents”.

- ABTA is designed for UK-purchased holidays that don’t include flights.

- ABTA enforces certain standards – and, perhaps more importantly, it provides insurance if a travel company gets into financial difficulty.

You can read more about ABTA on their website, here.

Travel Insurance

Whether it’s ABTA or ATOL protected, travel insurance is essential from the moment you book your cruise.

Well, ATOL and ABTA won’t cover you if you break your leg the day before your cruise and end up in hospital for three weeks.

Yes, it can happen.

So make sure you get travel insurance as soon as you book your cruise.

Credit Card Smart

One last tip.

Now that companies no longer charge a fee for paying by personal credit card, it’s worth considering paying for your cruise on a credit card to take advantage of the financial protection benefits your credit card company offers.

On top of that, if you use a cashback credit card, it’ll mean you’ll even get a little bit of money back.

Protection, and cashback.

What more can you ask for?

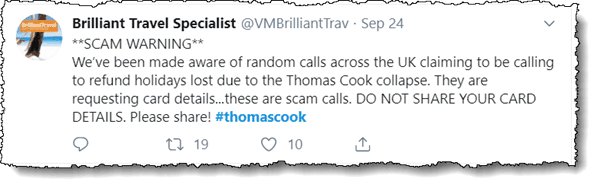

Scam Aware

I’m hearing stories of scammers calling people and claiming to be from “Thomas Cook Refunds”, asking for credit card details.

Don’t share your card details with them. It’s a scam.

Over To You

Have you been affected by the collapse of Thomas Cook?

How has it affected your cruise plans?

Have a Listen

Did you know that you can also listen to this on the podcast.

Enjoy!

Listen & subscribe on Apple, Spotify or Anchor

| Please note that whilst we endeavour to provide information accurately, because regulations can change over time we cannot guarantee the accuracy of the information here. None of this information is advice. Please ensure you’re properly protected when you book your cruise. |

Leave a Reply